Are renewable energies competitive?

The level of competitiveness of renewable energy depends on the energy service offered. Heat production from renewable energy sources is generally cost-effective. However, biofuels and “green electricity” are not yet competitive in terms of production costs. They are nevertheless made competitive on the market thanks to dedicated support mechanisms (subsidies, tax exemptions).

Biomass has been used for heat production since the dawn of time. In Switzerland almost 3% of the population heats with wood (logs, chips, pellets) without any subsidies, as this option is competitive with natural gas and heating oil. The same is true for heat pumps. On the other hand, thermal solar panels, which are mainly used for the production of domestic hot water, are competitive only in new buildings and benefit from subsidies for their installation in existing buildings.

In general, biofuels are still significantly more expensive to produce than fossil fuels (petrol, diesel, natural gas). In Switzerland, however, they are often competitive because they are exempt from the mineral oil tax, which is levied on fossil fuels. In the European Union, bioethanol and biodiesel are gaining market share, due to the obligation of the 28 member states to cover 10% of the energy in the transport sector with renewable energies by 2020 [→ Q89].

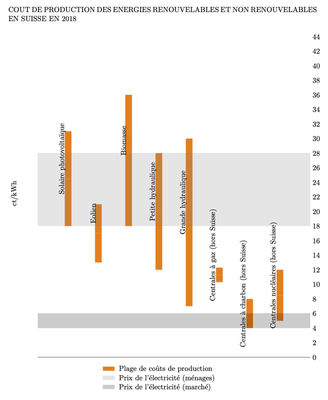

The cost of electricity from new renewable energies in Switzerland in recent years is as follows: 18-30 centimes per kWh for photovoltaics (domestic rooftop installations); 13-21 ct/kWh for wind power; 12-28 ct/kWh for small-scale hydropower; 18-36 ct/kWh for biomass (provided that waste heat is recovered) [→ see figure below]. However, electricity prices on the European market, of which Switzerland is a part, vary between 4 and 13 ct/kWh. It is therefore clear that Swiss “green electricity” is far from being competitive with current market prices. Aid is therefore necessary to enable them to gain market share. In Switzerland, the feed-in tariff remuneration system (RPC) plays a crucial role in this respect [→ Q79].

In reality, households in Switzerland buy their electricity at a much higher price: 18-28 ct/kWh (including grid feed-in tariffs), which is much higher than the 4-7 ct/kWh paid by electricity distributors on the European electricity exchange. It is therefore now possible, under favourable circumstances, to produce electricity from renewable sources below the price charged to the final consumer. In that case, experts say that renewable electricity has reached “grid parity”, which should enable large-scale deployment of renewable technologies. If the consumer, who buys his electricity at 24 cents per kWh, can produce and consume his own electricity at 19 cents thanks to solar panels, he will be tempted to do so. All the more so as the new legislation in force allows him to do so (2014 regulation on the right to self-consumption).

However, the liberalisation of the electricity market, which has been underway for several years, could jeopardise this logic. Today, households and small businesses are so-called “captive” customers of electricity companies. They cannot choose their electricity supplier, nor the price they pay (18-28 ct/kWh). With full liberalisation announced for 2018, but still in preparation, end customers will increasingly be able to purchase electricity on the open market, benefiting from potentially lower prices thanks to competition between producers. This is the case for large companies, which already have access to this market, and which have seen their electricity bills fall by 25 to 30%, to 13-18 ct/kWh. As a result, renewable electricity is no longer competitive either with electricity prices on the exchange (4-7 ct/kWh) or even with the prices paid by end users (13-18 ct/kWh).

The challenge for renewable electricity is to continue to bring its costs down. This will mainly be achieved by improving technologies and, to a lesser extent, by lowering market prices in Switzerland through the strengthening of the mass market. Above all, however, through architectural integration; if photovoltaic panels replace tiles or façade elements when renovating a building, then the cost of building elements (tiles, etc.) is reduced accordingly, and the effective cost of the solar kWh is further reduced by 20 to 30%.

The expected increase in the price of CO2 emissions on the European market will push up the market price of electricity. This expected development will also allow renewable options to improve their competitiveness, since they do not emit CO2 and are therefore not affected by changes in its price [→ Q83].

References

- AWP-ATS (2019)

- AWP-ATS (2019). Le conseil fédéral tient a libéraliser le marché électrique. [Online]. Available at: www.bilan.ch/economie/le-conseil-federal-tient-a-liberaliser-le-marche-electrique.

- Commission fédérale de l’électricité ElCom (2019)

- Commission fédérale de l’électricité ElCom (2019). Commission fédérale de l’électricité ElCom. [Online]. Available at: www.prix-electricite.elcom.admin.ch/Start.aspx?lang=fr.

- Office fédéral de l'énergie (OFEN) (2013)

- Office fédéral de l'énergie (OFEN) (2013). Prix du marché selon art. 3f, al. 3, OEne Déterminant pour le calcul du supplément RPC sur la base des prix pondérés en fonction du volume (SWISSIX base) et avec prise en compte du taux de change..

- Office fédéral de l'énergie (OFEN) (2017)

- Office fédéral de l'énergie (OFEN) (2017). Rétribution de l’injection (RPC) pour petites installations hydrauliques et installations éoliennes, géothermiques et de biomasse - Fiche d’information à l’intention des responsables de projets.

- THE EUROPEAN PARLIAMENT AND THE COUNCIL OF THE EUROPEAN UNION (2009)

- THE EUROPEAN PARLIAMENT AND THE COUNCIL OF THE EUROPEAN UNION (2009). DIRECTIVE 2009/28/EC OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 23 April 2009 on the promotion of the use of energy from renewable sources and amending and subsequently repealing Directives 2001/77/EC and 2003/30/EC. Official Journal of the European Union, 140. 16–62.

- Veigl (2015)

- Veigl, S. (2015). Rapport annuel 2014 - Fondation Rétribution à prix coûtant du courant injecté RPC.